An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

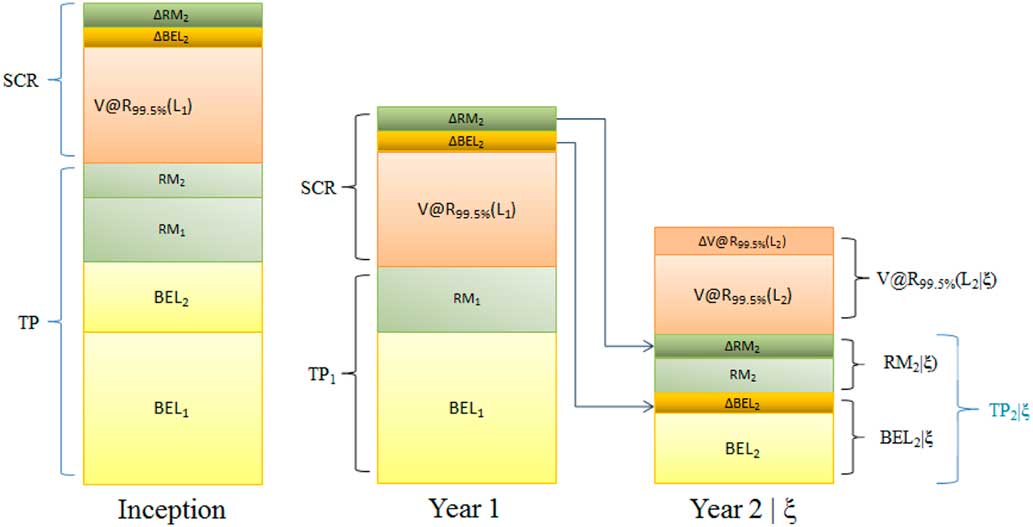

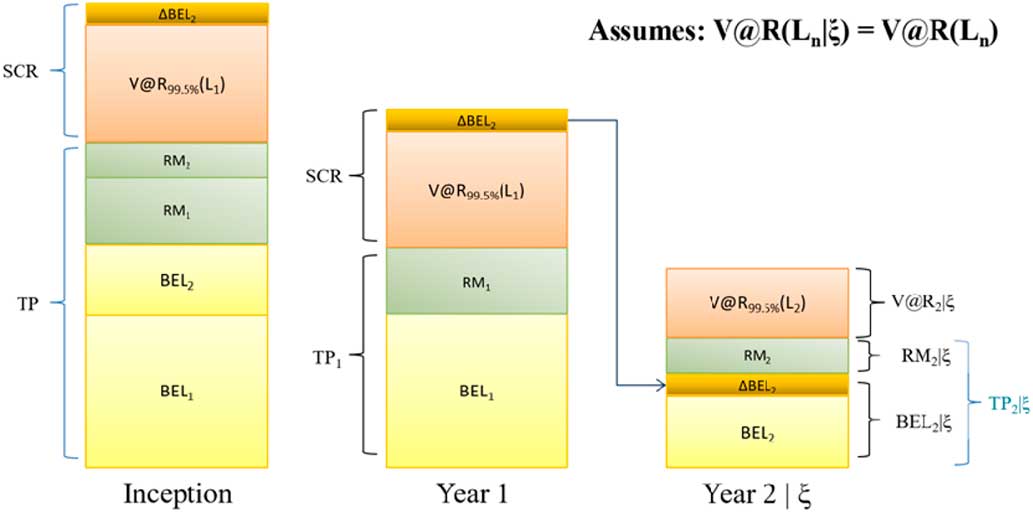

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

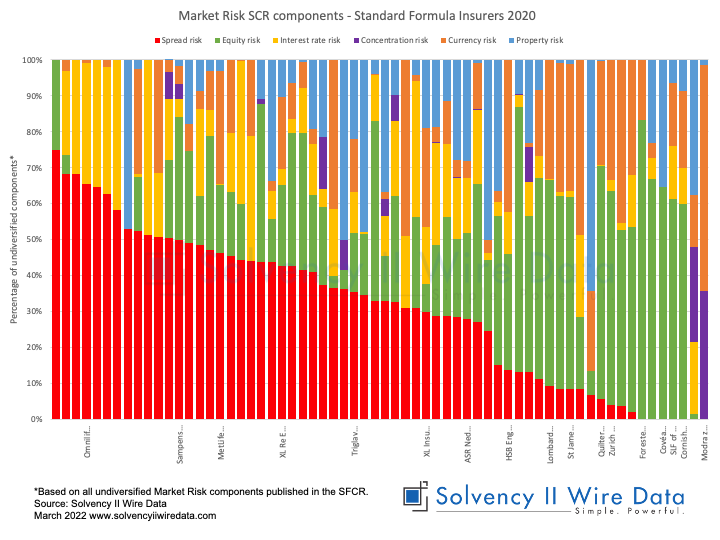

Quantifying credit and market risk under Solvency II: Standard approach versus internal model - ScienceDirect

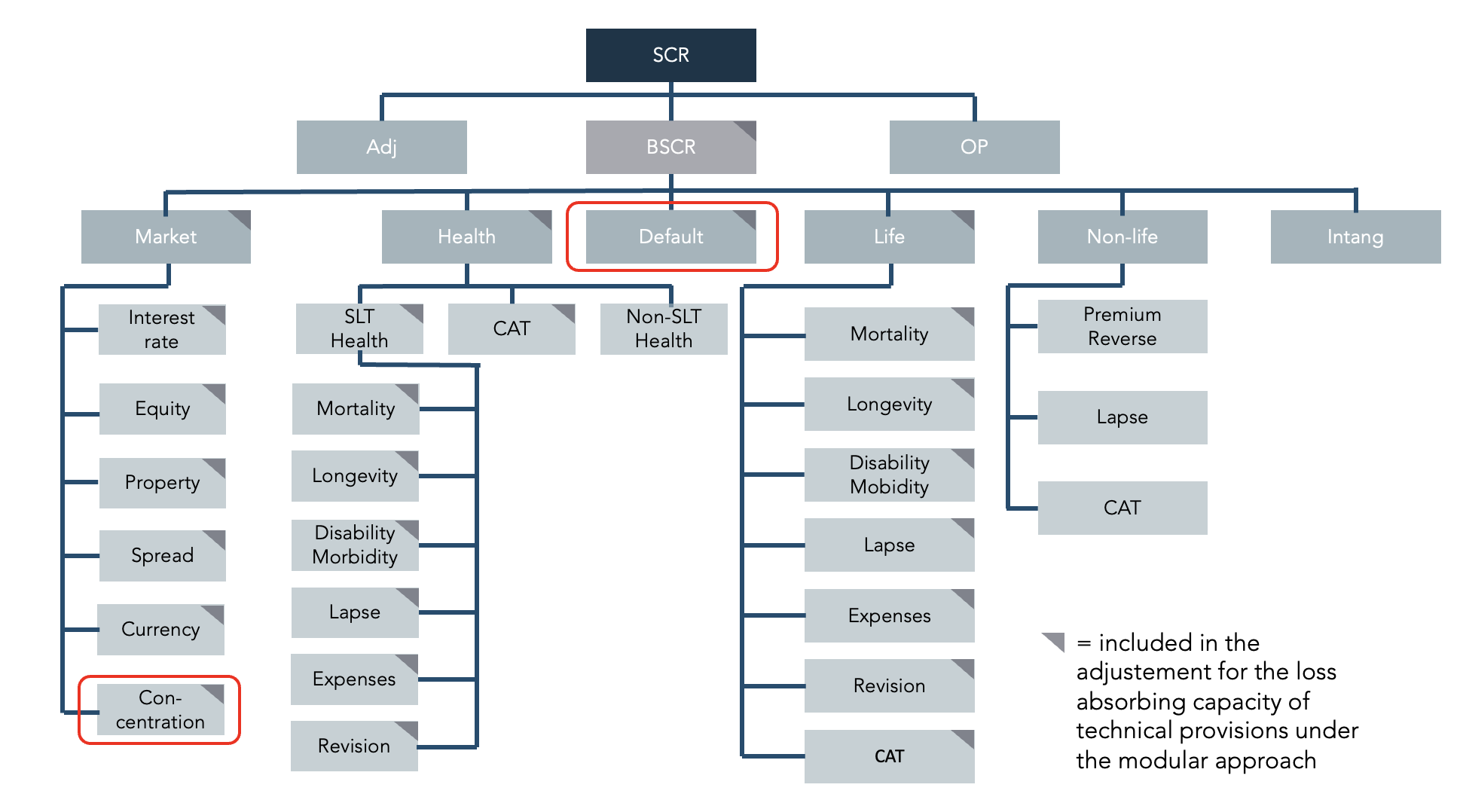

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

Solvency II. A comparison of the standard model with internal models to calculate the Solvency Capital Requirements (SCR) - GRIN

![PDF] Alternative Approaches to Regulatory Risk Calibrations in Solvency II | Semantic Scholar PDF] Alternative Approaches to Regulatory Risk Calibrations in Solvency II | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/b2da1489840c7630a6818b8d027df5033ed5969f/26-Figure3.2-1.png)